Delaware Catalyst Fund

A Public-Private Catalyst Loan Fund Investing in Delaware Communities

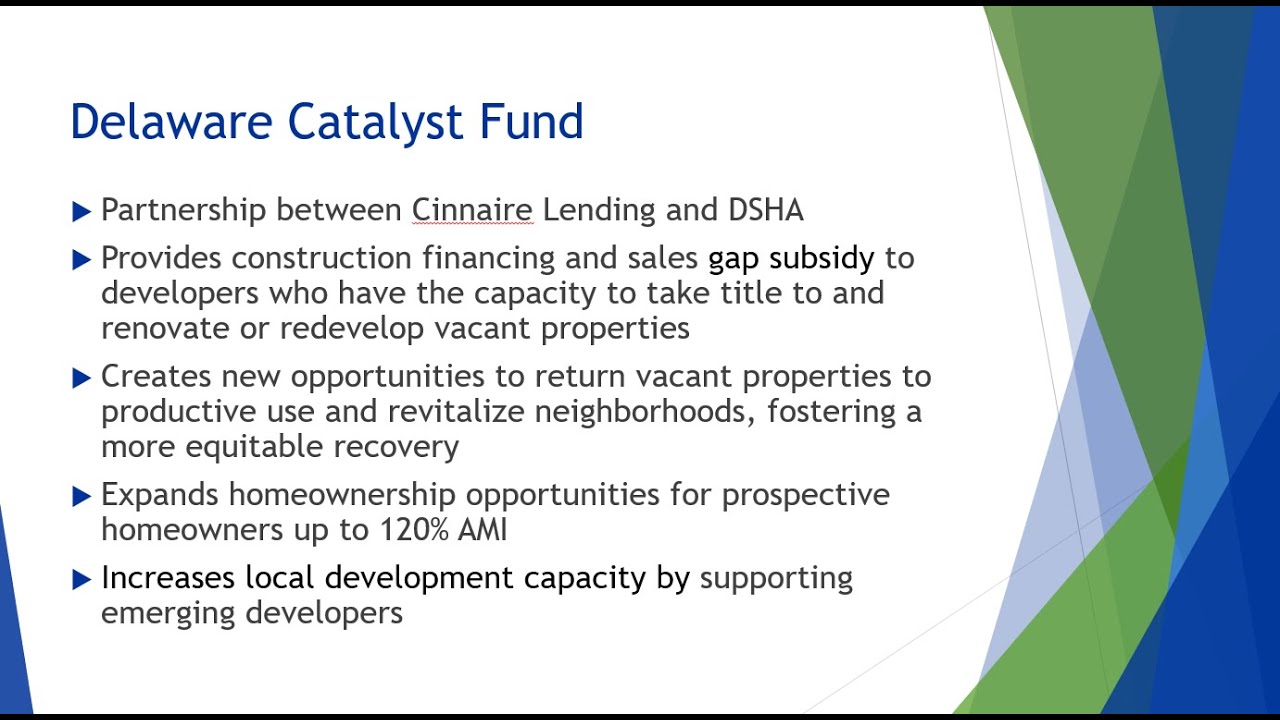

The Catalyst Fund is a partnership between Cinnaire and the Delaware State Housing Authority (DSHA) designed to address vacant property in communities in Delaware disproportionately impacted by the COVID-19 pandemic. Through the Catalyst Fund, both for-profit and nonprofit developers can apply for construction financing and subsidy needed to renovate vacant homes or build new homes on vacant land for affordable homeownership. Administered by Cinnaire, the Catalyst Fund will make up the gap between the cost of acquisition and renovation that too often stands in the way of equitable community revitalization in Delaware’s neighborhoods. The Catalyst Fund is also made possible by the generous support of WFSF and J. P. Morgan Chase.

Our

Vision

Healthier neighborhoods, built on equitable, inclusionary growth and redevelopment

“Public health researchers and advocates recognized that a person’s zip code can do more to determine her health (e.g. life expectancy) than her own genetic code…Poor conditions in homes can have a compounding effect on the health and welfare of low-income individuals.” -The Urban Institute

Round 2 of the Catalyst Fund Application Process has now closed.

Goals of the Catalyst Fund

Recognizing the importance of healthy neighborhood environments to public health and economic outcomes, Delaware Governor John Carney announced the Catalyst Fund partnership in July 2022. The Catalyst Fund will leverage funding provided by the State of Delaware through the American Rescue Plan Act’s State and Local Fiscal Recovery Fund (SLFRF) to respond to the negative impacts of the COVID-19 pandemic.

The CDC has recognized that “neighborhoods people live in have a major impact on their health and well-being.” Research has revealed correlations between high rates of vacant or abandoned properties in a neighborhood with worse physical health and mental health outcomes.

Vacant and abandoned properties also present a barrier to economic recovery. When neighborhoods face high concentrations of vacant properties or when properties remain vacant for long periods of time, the cost of renovation or redevelopment is often greater than the after-improved value, putting scalable and targeted revitalization efforts financially out of reach. In many neighborhoods facing high levels of vacancy, there is also a significant homeownership gap, negatively impacting neighborhood stabilization and growth. This is often compounded by the rising costs and limited availability of “move-in” ready homes for sale in these markets.

The Catalyst Fund will also take steps to encourage the participation of new and emerging developers in order to expand the pool of local developers to help scale development activity and support equitable revitalization and inclusive economic opportunity. The Catalyst Fund will be designed to reach new developers to engage them in returning vacant properties to productive use. The Catalyst Fund will expand opportunities for homeownership while increasing diversity in the state’s real estate development community.

By expanding opportunities for real estate developers with roots in local communities to participate in growth and revitalization efforts, the Catalyst Fund will help chart a new path toward inclusive economic opportunity and neighborhood revitalization.

Eligible Areas

To meet federal guidelines for the State and Local Fiscal Recovery Fund (SLRF) program and focus the resource, DSHA has identified specific geographic areas as eligible for Catalyst Fund activities.

The map identifies highly distressed neighborhoods with high levels of vacancy and abandonment. Strategies should be focused on stabilizing neighborhoods through reducing vacancy and promoting increased homeownership.

To find out if your community is eligible, please refer to the interactive eligibility map provided by DSHA.

Who Can Apply?

This program is open to both experienced and emerging developers

- For profit

- Non-profit

- Emerging Developers

Click here to watch Informational Workshop recordings:

Eligible Entities

For profit or 501(C)(3) non-profit developers — A developer (Owner) is any corporate entity, partner, or individual responsible for initiating and controlling a real-estate development project and ensuring that all phases of the development process are accomplished.

Emerging developers — An Emerging Developer is defined as a developer with some level of real estate development training that is seeking to build real estate experience. An emerging developer:

- Has developed fewer than 10 properties (Cannot include properties in which the developer has resided)

- Has completed a real estate development training program (e.g., the Jumpstart Wilmington developer training program) to expand their knowledge and skills in real estate development

- If operating as a non-profit organization, a 501(c)3 must already be established.

Additional Project Eligibility Requirements

Eligible Areas — Parcels must meet one of the following definitions in order to be eligible for Catalyst Fund construction financing and sales gap subsidy:

Blighted Structure: a structure is blighted when it exhibits objectively determinable signs of deterioration sufficient to constitute a threat to human health, safety and public welfare. Furthermore, DSHA considers a structure to be blighted if it does not meet the State of Delaware Housing Code or the local building code.

Vacant: an existing property is considered vacant when it has been empty for more than one year.

2024 Application Timeline - Closed May 30

April 29 – Catalyst Workshop 2

May 1 –Round 2 Opened at 8 AM EDT

May 15 – Notice of Intent to Apply

May 30 – Application Round 2 Closed

Steps Moving Forward

- Developers with an interest in renovating or building in targeted neighborhoods for homeownership production will apply for construction financing from Cinnaire Lending.

- Construction financing will be on terms and conditions determined by Cinnaire Lending and compliant with restrictions imposed for State and Local Fiscal Recovery Funds (SLFRF) established by the American Rescue Plan Act (ARPA)

- Financing approval will include review by DSHA to ensure that the development project is eligible for sales gap subsidy to be provided by DSHA through SLFRF.

- Sales gap subsidy will be available upon completion of the homeownership unit, sale to an eligible homebuyer, and submission of all required closing documents.

- DSHA’s sales gap subsidy will support the developer’s repayment of the construction financing provided by Cinnaire Lending.

- Developer fee is calculated at 15% of total development costs to a maximum of $20,000 per property.

Are you an Established Nonprofit Developer With Stable Sources of Construction Financing?

- Apply to DSHA for its Sales Gap Subsidy by completing the following documents:

- Catalyst Fund Self-Funded Application (Download to access editable file)

- Catalyst Fund Certification of Application Submission

- Sales Gap Subsidy Calculation Worksheet

- Property Condition Form

- Once you’ve completed these forms and gathered all the supporting documentation, call DSHA to register for its web-based application portal – contact Rochelle Knapp at 302-739-0326 for more information.

- If you have questions on the Sales Gap Subsidy being provided by DSHA, please email DSHA_CatalystFund@delaware.gov

Please complete all program materials and submit application to: decatalyst@cinnaire.com

Program Materials

Contact Us

For more information on how the Catalyst Fund will work, please contact DSHA at DSHA_CatalystFund@delaware.gov

For more information on construction lending and underwriting, please contact Cinnaire at DeCatalyst@cinnaire.com.

Our Locations

Home Office - Lansing

1118 South Washington

Lansing MI, 48910

Indianapolis

320 North Meridian, Suite 516

Indianapolis IN, 46204

Wilmington

100 W. 10th Street, Suite 502

Wilmington, DE 19801

Chicago

225 West Washington, Suite 1350

Chicago, IL 60606

Madison

10 E. Doty Street, Suite 617

Madison, WI 53703

Grand Rapids

100 Cesar E. Chavez Ave., Suite 202

Grand Rapids, MI 49503

Detroit

2111 Woodward Avenue, Suite 600

Detroit, MI 48201

Milwaukee

231 E. Buffalo Street, Suite 302

Milwaukee, WI 53202