Delaware Catalyst Fund

A Public-Private Catalyst Loan Fund Investing in Delaware Communities

The Catalyst Fund is a partnership between Cinnaire and the Delaware State Housing Authority (DSHA) designed to address vacant property in communities in Delaware impacted by the COVID-19 pandemic. Through the Catalyst Fund, both for-profit and nonprofit developers can apply for construction financing and subsidy needed to renovate vacant homes or build new homes on vacant land for affordable homeownership. Administered by Cinnaire, the Catalyst Fund will make up the gap between the cost of acquisition and renovation that too often stands in the way of community revitalization in Delaware’s neighborhoods. The Catalyst Fund is also made possible by the generous support of WFSF and J. P. Morgan Chase.

Our

Vision

Healthier neighborhoods, built on inclusionary growth and redevelopment

“Public health researchers and advocates recognized that a person’s zip code can do more to determine her health (e.g. life expectancy) than her own genetic code…Poor conditions in homes can have a compounding effect on the health and welfare of low-income individuals.” -The Urban Institute

Round 2 of the Catalyst Fund Application Process has now closed.

The CDC has recognized that “neighborhoods people live in have a major impact on their health and well-being.” Research has revealed correlations between high rates of vacant or abandoned properties in a neighborhood with worse physical health and mental health outcomes.

Vacant and abandoned properties also present a barrier to economic recovery. When neighborhoods face high concentrations of vacant properties or when properties remain vacant for long periods of time, the cost of renovation or redevelopment is often greater than the after-improved value, putting scalable and targeted revitalization efforts financially out of reach. In many neighborhoods facing high levels of vacancy, there is also a significant homeownership gap, negatively impacting neighborhood stabilization and growth. This is often compounded by the rising costs and limited availability of “move-in” ready homes for sale in these markets.

The Catalyst Fund will also take steps to encourage the participation of developers in order to expand the pool of local developers to help scale development activity and support revitalization and inclusive economic opportunity. The Catalyst Fund was designed to reach new developers to engage them in returning vacant properties to productive use. The Catalyst Fund will expand opportunities for homeownership.

By expanding opportunities for real estate developers with roots in local communities to participate in growth and revitalization efforts, the Catalyst Fund will help chart a new path toward inclusive economic opportunity and neighborhood revitalization.

Eligible Areas

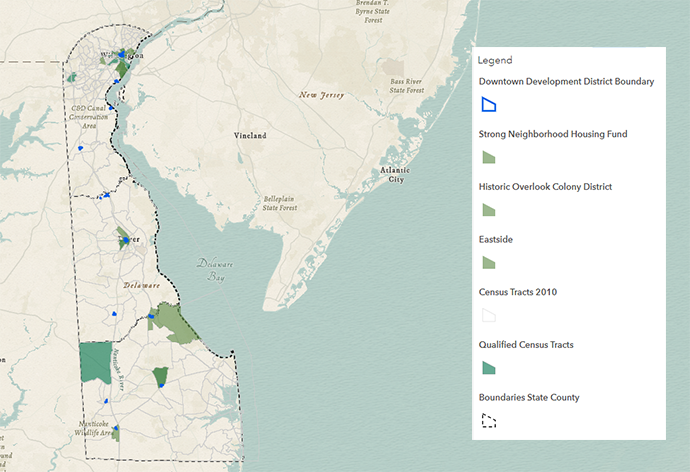

To meet federal guidelines for the State and Local Fiscal Recovery Fund (SLRF) program and focus the resource, DSHA has identified specific geographic areas as eligible for Catalyst Fund activities.

The map identifies highly distressed neighborhoods with high levels of vacancy and abandonment. Strategies should be focused on stabilizing neighborhoods through reducing vacancy and promoting increased homeownership.

To find out if your community is eligible, please refer to the interactive eligibility map provided by DSHA.

Steps Moving Forward

- Developers with an interest in renovating or building in targeted neighborhoods for homeownership production will apply for construction financing from Cinnaire Lending.

- Construction financing will be on terms and conditions determined by Cinnaire Lending and compliant with restrictions imposed for State and Local Fiscal Recovery Funds (SLFRF) established by the American Rescue Plan Act (ARPA)

- Financing approval will include review by DSHA to ensure that the development project is eligible for sales gap subsidy to be provided by DSHA through SLFRF.

- Sales gap subsidy will be available upon completion of the homeownership unit, sale to an eligible homebuyer, and submission of all required closing documents.

- DSHA’s sales gap subsidy will support the developer’s repayment of the construction financing provided by Cinnaire Lending.

- Developer fee is calculated at 15% of total development costs to a maximum of $20,000 per property.

Are you an Established Nonprofit Developer With Stable Sources of Construction Financing?

- Apply to DSHA for its Sales Gap Subsidy by completing the following documents:

- Catalyst Fund Self-Funded Application (Download to access editable file)

- Catalyst Fund Certification of Application Submission

- Sales Gap Subsidy Calculation Worksheet

- Property Condition Form

- Once you’ve completed these forms and gathered all the supporting documentation, call DSHA to register for its web-based application portal – contact Rochelle Knapp at 302-739-0326 for more information.

- If you have questions on the Sales Gap Subsidy being provided by DSHA, please email DSHA_CatalystFund@delaware.gov

Please complete all program materials and submit application to: decatalyst@cinnaire.com

Program Materials

Contact Us

For more information on how the Catalyst Fund will work, please contact DSHA at DSHA_CatalystFund@delaware.gov

For more information on construction lending and underwriting, please contact Cinnaire at DeCatalyst@cinnaire.com.

Our Locations

Lansing

1118 South Washington

Lansing MI, 48910

Indianapolis

201 North Illinois Street

Suite 1530

Indianapolis IN, 46204

Wilmington

100 W. 10th Street, Suite 502

Wilmington, DE 19801

Chicago

225 West Washington

Suite 1350

Chicago, IL 60606

Madison

10 E. Doty Street, Suite 617

Madison, WI 53703

Grand Rapids

100 Cesar E. Chavez Ave.

Suite 202

Grand Rapids, MI 49503

Detroit

2111 Woodward Avenue, Suite 600

Detroit, MI 48201