Cinnaire, A Trusted Lending Partner

Cinnaire Lending

We invest in people and places to transform lives through capital investments and development solutions. Cinnaire’s lending program is guided by this principle. Cinnaire Lending is committed to building strong communities by providing financing for affordable housing, education, healthcare, community facilities and economic development. As a national certified Community Development Financial Institution, we are a trusted partner with nonprofit organizations, government agencies and mission-driven businesses to connect communities, regardless of income or zip code, with financing that supports economic growth and opportunity.

Headquartered in Lansing, MI, with offices in five states, Cinnaire provides access to investment funding, lending options, and title services that support community and economic development, creating stable, sustainable and vibrant communities.

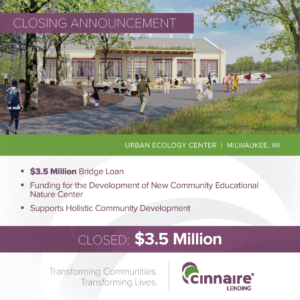

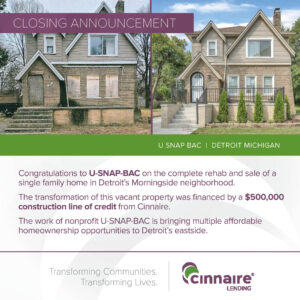

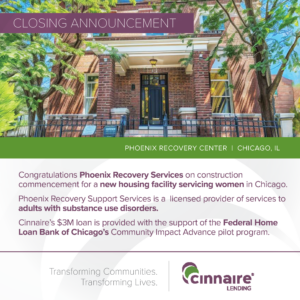

Closing Announcements

INNOVATIVE IDEAS AND POWERFUL SOLUTIONS

CDFI Lending

Access to quality and affordable homes is a critical component to creating healthy communities. Cinnaire Lending offers a broad toolkit of products to support housing development, economic development and healthy communities. Leveraging LIHTC, NMTC and Historic Tax Credits, we are able to finance affordable real estate projects that create opportunities in low-income communities.

CPC Mortgage

Cinnaire is a cooperative owner in CPC Mortgage Company, the first-of-its-kind nonprofit multifamily mortgage lender with multiple licenses with Freddie Mac, Fannie Mae and HUD/FHA. Through CPC Mortgage, we have a one-stop-shop providing our borrowers with a team of originators, analysts and underwriters solely dedicated to the multifamily Agency lending process.

Federal Home Loan Bank of Chicago

Cinnaire is a member of the Federal Home Loan Bank of Chicago (FHLBC), giving our clients access to its full suite of products. An important product for rental properties is the Affordable Housing Program, or AHP, which awards grant subsidies through a competitive process. These valuable grants, which do not have to be paid back, provide gap funding for affordable rental projects and dovetail well with LIHTC funding.

Since 1993, Cinnaire has invested $6.3 billion to revitalize communities, resulting in more than $11.7 billion in community impact. Cinnaire has supported 1,100 housing developments, provided 69,000 affordable homes and created or retained more than 98,000 jobs.

Our Locations

Lansing

1118 South Washington

Lansing MI, 48910

Indianapolis

201 North Illinois Street

Suite 1530

Indianapolis IN, 46204

Wilmington

100 W. 10th Street, Suite 502

Wilmington, DE 19801

Chicago

225 West Washington

Suite 1350

Chicago, IL 60606

Madison

10 E. Doty Street, Suite 617

Madison, WI 53703

Grand Rapids

100 Cesar E. Chavez Ave.

Suite 202

Grand Rapids, MI 49503

Detroit

2111 Woodward Avenue, Suite 600

Detroit, MI 48201