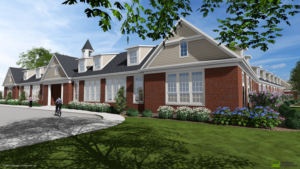

Cinnaire Lending announced a $6M Construction/Bridge Loan to support the development of Seymour Condominiums, an innovative affordable homeownership community led by ICCF Community Homes in Grand Rapids, Michigan. This transformative project will convert the former Seymour Christian School into 19 for-sale condominium units, with an additional eight newly constructed condos on the property, creating 27 mixed-income homeownership opportunities for the community.

Seymour Condominiums is designed to address the urgent need for affordable and workforce housing in Grand Rapids. Through a shared equity model, homeowners will own their condo units, while the ICCF Community Homes Land Trust (CHLT) retains ownership of the land, ensuring long-term affordability. ICCF established CHLT in 2019 to create lasting homeownership opportunities for West Michigan families, allowing them to purchase safe, affordable homes while ensuring affordability for future generations.

Affordable Homeownership Opportunities

With an estimated as-completed market value of $351,000 per condo, Seymour Condominiums will offer homes at significantly reduced prices to income-qualified buyers:

- $175,000 for households earning below 80% of the Area Median Income (AMI)

- $230,000 for households earning between 80% and 120% AMI

By providing this $6 million loan, Cinnaire Lending plays a critical role in financing this innovative development, ensuring that more families in Grand Rapids have access to stable, affordable homeownership opportunities.

A Collaborative Financing Effort

The $6 million loan from Cinnaire Lending is part of a larger capital stack, leveraging multiple funding sources to bring this vision to life:

- IFF – $4,000,000 construction loan

- MSHDA Missing Middle Grant – $1,890,000

- MEDC RAP Grant – $1,880,550

- City of Grand Rapids HOME Funds – $600,000

- City of Grand Rapids Brownfield Redevelopment Authority Loan – $875,000

- Federal Project Allocation (Rep. Hillary Scholten’s office) – $1,616,279

- Permanent Loan (IFF) – $1,215,000 (bridging net proceeds of a 20-year, $2,000,000 Brownfield TIF)

“Seymour Condominiums is a testament to the power of collaboration and innovative financing in addressing the growing need for affordable homeownership,” said Sarah Greenberg, President, Cinnaire Lending. “At Cinnaire, we are committed to investing in projects that create quality, long-term solutions for housing stability. We are proud to support ICCF Community Homes in their mission to provide sustainable, affordable homeownership opportunities that will strengthen families and communities for generations.”

Seymour Condominiums represents a model for adaptive reuse and sustainable affordability, transforming a historic school into a thriving residential community.

Watch this video on the genesis of the Seymour Condominium project.